Chapter 3: The Accidental Birth of Capital Trade

Prior to forming CapTrade, we spent three years at ICF Consulting Associates, a mid-sized multi-practice firm located right over the Farragut West Metro at 1875 K Street, NW. But, in late 1991, the recently-listed ICF announced large losses and decided to retreat back to its “core” areas. In retrospect, ICF served as our “half-way house”: for three years, we operated as a separate profit center within the infrastructure of a large consulting firm. An important lesson learned in those years is that we could manage our own practice. Our ICF overlords had pretty much left us alone to do our own thing, and, unlike our prior home at Coopers & Lybrand, we were responsible for finding all of our own clients and recruiting our own personnel. ICF also allowed us to see our financials, which gave us an idea of how much it really cost to run a consulting business. After three years at ICF, the move to complete independence was not such a big step.

But mentally, we weren’t quite there yet. We had always practiced under a larger umbrella that provided infrastructure: offices, phones, fax machines, computer, health insurance and payroll services. Soon after deciding to go out on our own, we began intensive negotiations with our ICF colleagues who were in the economics/antitrust/competition space. We had worked with them on a number of projects, so we knew that there were synergies between our practices. As their business was much more established, they had a much better idea of what was needed to make a consulting practice work. Negotiating business deals with economists, however, is/was a rocky business. Our discussions went down to the final week prior to our planned departure from 1875 K Street, NW. On our last Friday at ICF, the negotiations with the competition economists fell through. We truly were on our own, with no place to sit, no computers, phones, photocopiers or fax machines.

We had very little time to come up with a Plan B. Because they were downsizing, ICF had plenty of space, including the offices we were sitting in! Why not call and ask if we could just stay put for a few months, while we figured things out? Out of desperation, we called our soon-to-be former employers. That must have been a strange phone call for them – these crazy trade guys, calling on their last day, to haggle! The deal we proposed was simple: for the next three months, our new independent firm would stay in the same space we were currently sitting, using the same computers, phones, and photocopiers. In exchange, ICF would offset some of the deferred compensation owed to us. We dickered over the proper rental rate but came to an agreement fairly quickly. The barter deal between one cash-short entity and a company with too much overhead made perfect sense. ICF immediately accepted, so we showed up the next Monday morning at our same offices.

One of the biggest challenges in setting up a new firm was coming up with a name. Economic consulting firms like to names themselves after rivers (e.g., Charles River), but Potomac Economics was already taken. Here are a few of the options we considered:

· Phoenician Sciences – The Phoenicians were the great traders of the ancient world. We could have a trireme as our corporate logo. Shot down as being too esoteric.

· Agora Analytics – “agora” being Greek for market place. Pluses: great alliteration. Classically classy. Minuses: too esoteric (once again), no reference to location.

· TradEcon – a mash-up of “trade” and “economics”. Such mash-ups were not as common back then as they are now. We were too far ahead of our time. Besides, it sounded vaguely reminiscent of a Russian trading company. Left on the cutting room floor.

We settled on Capital Trade Incorporated mainly because it was the least common denominator – the only name we could agree on. It turned out to be a great choice, however, as it combined our principal location and focus into our corporate identifier.

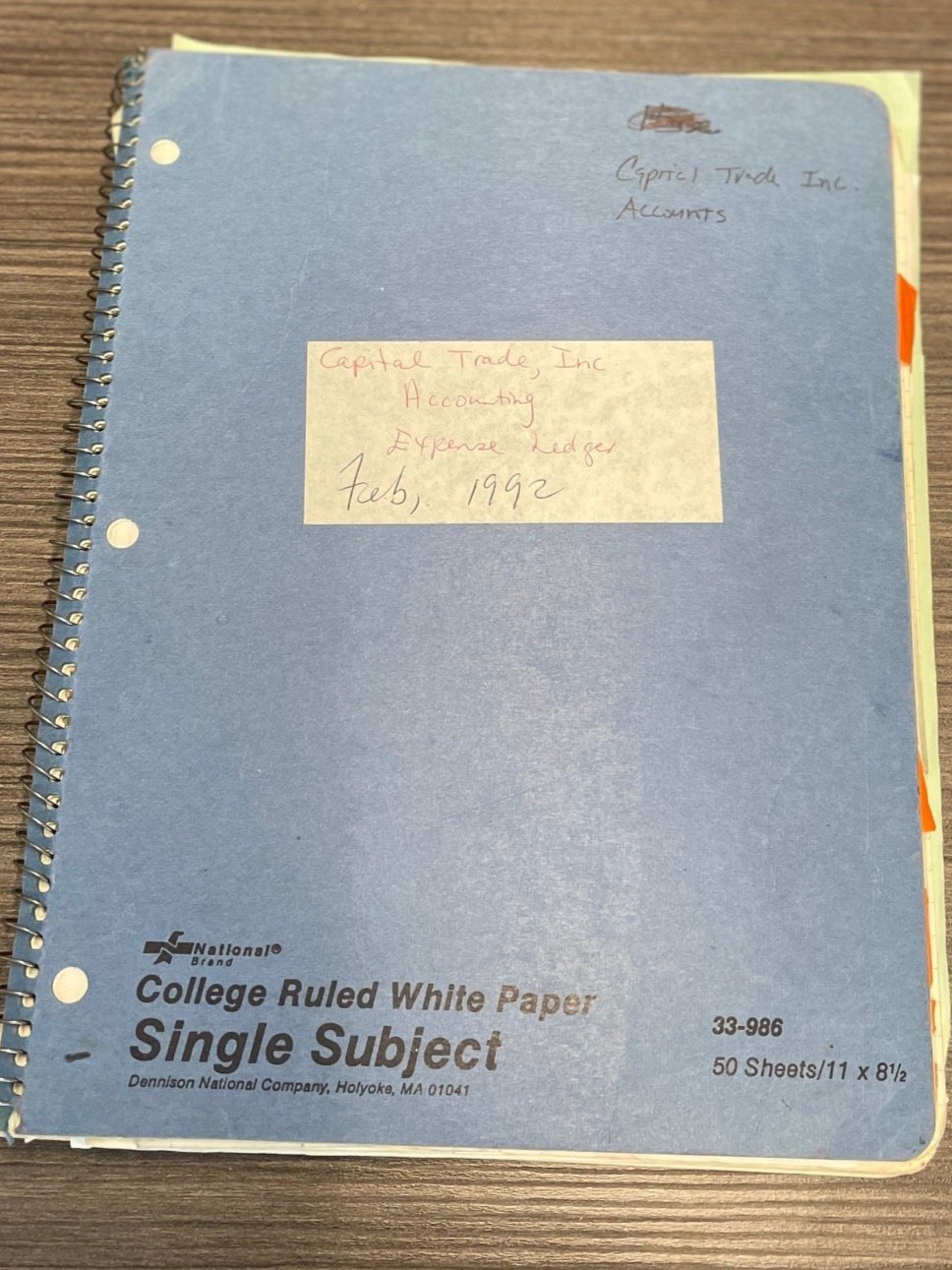

Our official start date was February 28, 1992. We converted a spiral notebook into our first accounting ledger, and fashioned a logo that combined the Capitol dome with a globe. In starting up a business, luck can be enormously important. Luckily, we started with clients from the “get-go.” ICF did not want any of our clients suing them for unrendered services, so they “made” us sign an agreement stating that we would take all of our clients with us! And even more fortunate, we had just hired a new office manager for our practice several months prior to leaving ICF. Our first paid employee, Viviene Ramgeet, became our one and only office administrator. “Vivs” is still with us today!

Even with those advantages, the start-up was tough. We all had, or soon were to have, young families. We were looking at an unknown number of months of no pay. Luck, once again, was in our favor. On the eve of our departure, “Godot” showed up on our doorstep…..

Next up: Chapter 4: Godot Arrives